Thinking about spending your golden years under the sun? You’re not alone! Many long-time expats and global professionals dream of retiring in the UAE. It’s no surprise with its incredible lifestyle and modern comforts. You don’t even have to stress about income tax.

The retirement visa in Dubai makes that dream possible. This 5-year renewable visa is designed for individuals aged 55 and older who meet specific financial criteria.

The guide provides you with the full picture. You’ll get eligibility criteria and costs to benefits, and how to apply. Let’s break it down step by step!

Why Retire in Dubai or the UAE?

Dubai isn’t just a place, it’s a lifestyle. Whether you’re after luxury, stability, or sunshine, this city ticks every box. It’s a place where you can avail of everything that your heart desires. The city welcomes you with open arms to come and retire here and spend your golden years.

Safety, Luxury, and Modern Living

Dubai ranks among the safest cities in the world. The city has very low crime rates. The Dubai government is stable and pro-expat. You can enjoy its ultra-modern infrastructure. Just think driverless metro, top-tier malls, and luxury resorts. All while resting your best time in Dubai.

Healthcare, Climate, and Cultural Diversity

The healthcare of Dubai is famous around the world. You can access world-class hospitals and clinics according to your accessibility. Sunshine all year long whenever you want. Your days will be perfect for beach days and golf rounds. Not only this, but Dubai is a melting pot of cultures. Over 200 nationalities call the UAE home. This creates a welcoming vibe for everyone.

Thousands of Expats Trust Our Guidance to Secure Their UAE Retirement Visa Smoothly

What Is the UAE Retirement Visa?

The retirement visa UAE is a 5-year renewable residency visa for people aged 55 and above. It’s part of a government initiative to support long-time expats and global citizens who want to retire in the UAE.

Retire in Dubai Visa vs. Other Visa Types

So, how is the retirement in Dubai visa different from others?

| Visa Type | Main Purpose | Duration | Can Work? | Best For |

| Retirement Visa | Retiring in the UAE after age 55 | 5 years (renewable) | No | Expats & retirees |

| Family Visa | Joining family members | 1-2 years | No | Spouses, kids |

| Golden Visa | Long-term investment-based residency | 10 years | Yes | Investors, entrepreneurs |

| Work Visa | Employment-based residency | 2-3 years | Yes | Employees |

Curious about other visas? You can check out the different types of visas in the UAE on our website.

Designed for Expats & Residents

The retirement visa in the UAE is perfect for long-time UAE residents getting ready to retire. It is also ideal for International retirees with financial independence.

If you’ve heard about the UAE Golden Visa but don’t qualify, this could be your next best option.

Understanding the 5-Year Retirement Visa in the UAE

The 5-year retirement visa in UAE is one of the most attractive long-term residency options for retirees. It’s designed to give you financial stability, peace of mind, and the flexibility to renew every five years.

Key Highlights of the 5-Year Retirement Visa:

- Validity: 5 years, renewable upon meeting eligibility criteria.

- Purpose: Residency for retired individuals aged 55 and above.

- Renewal: Based on continued fulfillment of financial or property requirements.

- Freedom: No sponsor required, and full autonomy over your stay.

This visa ensures retirees can enjoy life in the UAE without the stress of frequent renewals. It also makes the UAE an appealing choice compared to countries that offer only short-term retirement permits.

UAE Retirement Visa Requirements

No longer wait to apply for your retirement visa. Just fulfill the necessary requirements and apply for your retirement visa. The Dubai retirement visa requirements are a little longer, but simpler than you think.

To apply for a retirement visa in Dubai, you’ll need to meet specific age, financial, and health criteria. The essentials have been discussed below for your better understanding.

Age & Health Insurance

You must be 55 years or older to apply for a retirement visa. To apply, first you must hold a valid UAE-wide health insurance policy.

Financial Eligibility – Choose One of the Three Routes

You only need to meet one of the following:

| Route | Criteria |

| Monthly Income | AED 20,000 per month (from pensions, investments, etc.) |

| Savings | AED 1 million fixed deposit for 3 years in a UAE bank |

| Property Ownership | Real estate in the UAE worth AED 2 million, fully owned |

| Combo Option | Savings + Property totaling AED 1 million combined |

Required Documentation

Gather these before you apply:

- Passport copies (yours + dependents)

- Proof of income or savings

- Title deed (if applying via property)

- Marriage certificate (if sponsoring spouse)

- Emirates ID (if already in UAE)

- Valid health insurance certificate

- Medical fitness test results

Now, you’ll know what actually are the retirement visa UAE requirements are and apply easily.

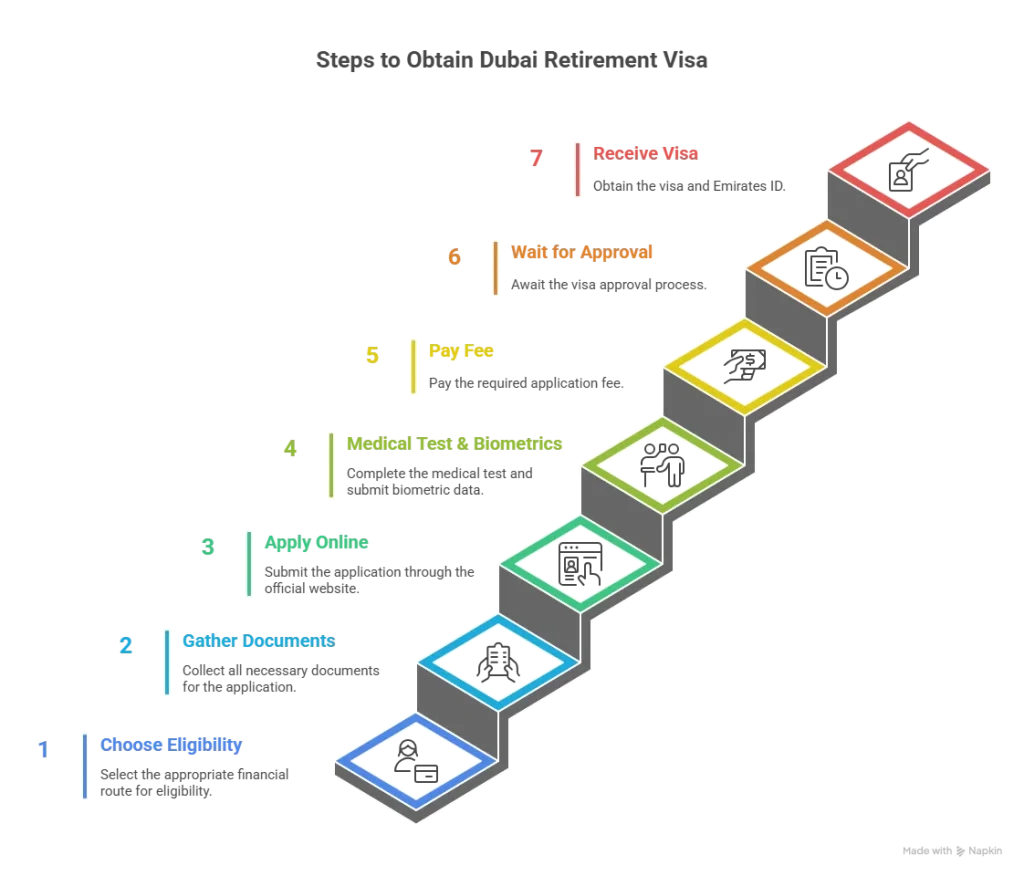

How to Apply for a Retirement Visa in Dubai

The Dubai visa process is easier than you might expect as long as you’re prepared. Below is the step-by-step process to apply for your retirement visa today, quickly and simply.

Step-by-Step Application Process

- Choose your financial eligibility route.

- Gather all required documents.

- Apply online via retire in Dubai or through Dubai Tourism.

- Take your medical fitness test and submit biometrics.

- Pay the application fee.

- Wait for visa approval (2-4 weeks).

- Receive your visa and Emirates ID.

Processing Time & Costs

The retirement visa fee is AED 888. This includes medical + Emirates ID charges. The processing time is 2 to 4 weeks. The visa validity is for 5 years and is renewable.

Don’t Risk Delays or Costly Mistakes in Your UAE Retirement Visa Process

UAE/Dubai Retirement Visa Benefits

The list is quite long when we talk about the retirement visa advantages. The visa allows you to enjoy a longer legal stay in the UAE. You have financial freedom by having a tax-free zone.

Not only this, but you can invite your family to start living with you by sponsoring them. In short, the UAE retirement visa benefits go beyond just legal stay. You can have all that you had desired before.

Long-Term Legal Stay

No need to work or find a sponsor. Live for a longer time legally. Plus, you can travel in and out of the UAE with ease, with an option to renew every 5 years.

Financial Freedom in a Tax-Free Zone

The visa offers you financial freedom. You have no income tax on pensions, savings, or rental income. The visa gives you more room for financial planning and capital preservation.

Family Sponsorship Possibilities

You can even bring the family by sponsoring your spouse and children under this visa. Build a shared retirement life together.

Learn how this differs from a family visa in the UAE here.

Access to Public & Private Services

With this visa, you can access the UAE’s premium healthcare system. Set up utilities, bank accounts, and phone plans. The Dubai retirement visa allows you to enroll dependents in private schools if needed.

Cost of Retiring in Dubai

Worried about the retirement UAE visa cost? Well, you don’t need to worry anymore. We’ve simplified the cost incurred. This helps you to plan ahead and budget accordingly. Here’s what it may cost you monthly, and how to plan smart.

Monthly Budgeting Tips

| Expense Type | Estimated Monthly Cost (AED) |

| Rent | 4,000 – 10,000 |

| Groceries | 1,500 – 2,000 |

| Health Insurance | 800 – 1,500 |

| Utilities + Internet | 800 – 1,200 |

| Entertainment | 1,000+ |

Planning your budget smartly is a win-win situation for you. You can spend AED 4000 to AED 10,000 on renting. The monthly groceries will cost you around AED 1500 to AED 2000.

However, if you go for health insurance, don’t spend more than AED 1,500 on it. Plus, the utility and internet charges should be between AED 800 to AED 1200. Lastly, you can increase or decrease entertainment expenses. It should be around AED 1000.

Total Estimate: AED 10,000 – 18,000/month, depending on your lifestyle.

Financial Planning for Long-Term Retirees

A 5-year visa allows you to plan finances more efficiently. Whether you’re a resident preparing for retirement or an expat relocating, setting up sustainable income streams is key.

Smart Financial Tips:

- Keep a UAE-based bank account active for smooth renewals.

- Maintain minimum income or property eligibility to avoid rejection during renewal.

- Explore health and life insurance policies that cover retirees.

Diversify savings between local and international assets for better liquidity.

Owning vs. Renting Property

Owning qualifies you for the visa and gives long-term savings. However, renting offers flexibility but adds recurring costs.

Retirement Visa for UAE Residents Transitioning from Work

If you already live and work in the UAE, transitioning is smoother. All you need is the right knowledge and the necessary details in place.

Switching From Employment Visa to Retirement Visa

You can switch from an employment visa to a retirement visa, but start planning 6–12 months before retiring. Keep UAE bank accounts and residency active before your retirement. Avoid last-minute gaps in your visa. This helps you with a quicker process. For a smoother change, explore the visa transfer UAE processes.

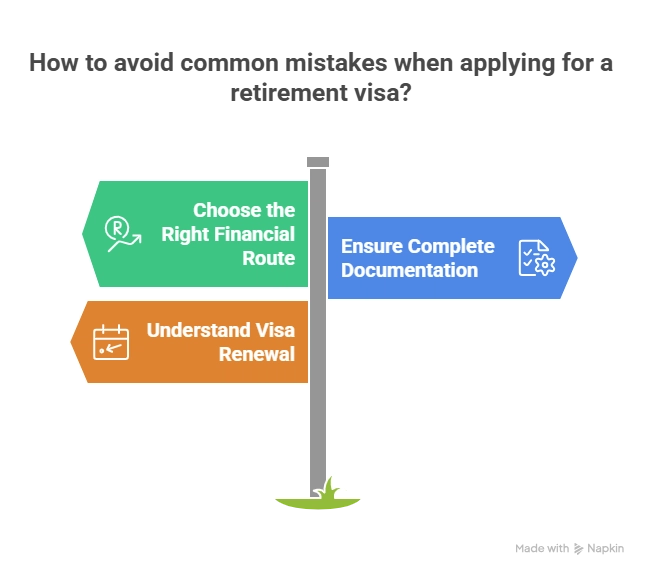

Common Mistakes to Avoid When Applying

Numerous mistakes individuals are making when applying for their retirement visa. Knowing these mistakes beforehand eliminates you from the delayed process. Avoid these to get approved on the first try.

Mistake 1 – Choosing the Wrong Financial Route

Pick the route you most easily qualify for. Don’t force fit one.

Mistake 2 – Incomplete Documentation

Missing even one document can lead to delays or rejections.

Mistake 3 – Assuming It’s Permanent

The visa is renewable, not permanent by default.

These common mistakes give you awareness and will help you in coping with the reasons for visa rejection in the UAE.

How to Renew Your UAE Retirement Visa

Still financially eligible? Renewal is a breeze. The renewal process for your retirement visa can be quick or immediate, based on fulfilling the requirements. Let’s find out what those requirements are to include your name in the list of eligible individuals.

Checklist for Renewal

Confirm you still meet financial requirements and keep your insurance policy active. Make sure that you pay renewal fees on time.

What Happens After the 5-Year Retirement Visa Expires?

After the 5-year term, you can renew your retirement visa in UAE easily by proving that you still meet the eligibility requirements.

If, however, you no longer qualify, you can explore:

- Switching to a family visa (if your spouse or child sponsors you).

- Applying for a Golden Visa, if you meet investment criteria.

- Temporary visit visas, if you wish to stay short-term.

The renewal process is straightforward, provided your insurance, financials, and residency documents are up-to-date.

Final Thoughts: Should You Retire in the UAE?

Comfort, safety, and freedom! The UAE offers retirees a unique blend of luxury and simplicity. With zero tax, a modern lifestyle, and year-round sunshine, it’s easy to see why many choose to retire in Dubai.

Ready to start planning? Speak to professional UAE visa consultants who can guide you step by step.

Looking for premium packages? Explore Royal Visa services for high-net-worth individuals looking for white-glove processing.

Secure Long-Term Residency for You and Your Family with the UAE Golden Visa.

FAQs About the UAE Retirement Visa

Can I Apply for A Retirement Visa if I’m Still Employed?

Yes, but you must retire in the UAE officially before the visa is issued.

Can I Apply for The Retirement Visa from Outside the UAE?

Absolutely. You can start the process online and enter once approved.

Can I Bring My Spouse or Dependents with Me?

Yes, as long as you can show financial ability to support them.

What Happens if I Don’t Meet Renewal Criteria After 5 Years?

You’ll need to switch to another visa or exit the country before expiry.