Planning to move to the UAE for work, business, or family reasons? Getting a UAE residence visa is the first step toward building a secure and rewarding life in one of the world’s most vibrant countries.

Beyond just legal residency, it unlocks countless privileges – from access to tax-free income and top-notch healthcare to the ability to own property and travel freely.

In this guide, we’ll walk you through everything you need to know about the UAE residence visa benefits, eligibility, renewal process, and even some exclusive privileges available to residents.

What Is a UAE Residence Visa?

Before diving into the advantages, let’s clarify what exactly a UAE residence visa is.

A residence visa allows non-UAE nationals to live legally in the country for an extended period – typically two to ten years – depending on the visa category. Whether you’re employed, running a business, studying, or reuniting with family, this visa is what grants you long-term stay rights.

Key Features of the UAE Residence Visa

- Validity usually ranges from 2 to 10 years based on the visa type.

- It can be renewed upon expiration with proper documentation.

- Allows residents to sponsor family members and domestic workers.

- Provides access to essential services such as healthcare, education, and banking.

- Enables opening bank accounts, obtaining a UAE driver’s license, and leasing property.

Put simply, holding a UAE residence visa makes you a recognized resident of the country, not just a visitor.

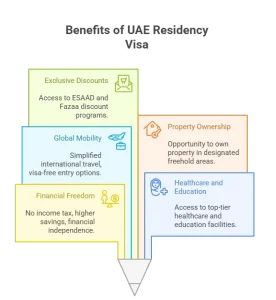

Top Benefits of Holding a UAE Residence Visa

Living in the UAE comes with advantages that extend far beyond sunshine and skyscrapers. Here’s why holding a UAE residence visa is one of the most sought-after privileges for expatriates.

Financial Freedom with Tax Benefits

Perhaps the biggest appeal of UAE residency is zero personal income tax. Residents can earn their salary, business profits, or freelance income without paying income tax, allowing for higher savings and better financial freedom.

This makes the UAE an attractive destination for professionals, entrepreneurs, and investors from around the globe.

Access to World-Class Healthcare and Education

A residence visa ensures access to some of the best hospitals and clinics in the Middle East. With mandatory health insurance in most Emirates, residents enjoy high-quality medical services.

Families also benefit from top-rated international schools and universities, giving children access to globally recognized education systems while enjoying the cultural safety and modernity of the UAE.

Easy Travel and Global Mobility

Holding a UAE residence visa simplifies international travel. Many countries offer visa-on-arrival or visa-free entry to UAE residents, particularly those holding passports from countries with strong diplomatic ties to the Emirates.

This flexibility is especially useful for business professionals and frequent travelers.

Opportunity to Own Property

Select visa types allow foreigners to buy and own property in designated freehold areas of Dubai, Abu Dhabi, and other Emirates.

Property ownership not only gives a sense of permanence but also can help in visa eligibility renewals and long-term residency options.

Access to Exclusive Discount Programs

Being a resident comes with lifestyle perks that make everyday life even more rewarding.

UAE residents can apply for:

- ESAAD Card – a government-backed privilege card offering discounts and offers across thousands of outlets in the UAE and abroad, covering hospitality, healthcare, entertainment, and more.

- Fazaa Card – another popular program offering discounts, travel benefits, and emergency assistance services for residents.

These programs are designed to reward long-term residents and improve the overall quality of life in the UAE.

Who Can Apply for a UAE Residence Visa?

The UAE offers residence visas to several categories of applicants, depending on their purpose of stay. Here’s a breakdown:

For Employees

If you’re employed by a UAE-based company, your employer typically sponsors your visa. Once approved, you can legally live and work in the UAE as long as your employment contract is valid.

For Investors and Business Owners

Investors and entrepreneurs can apply for visas linked to their company ownership or property investment. This visa category often allows longer validity periods and easier renewals, especially if the investment meets certain thresholds.

For Family Members

Residents can sponsor their spouse, children, and sometimes parents, provided they meet the minimum salary and accommodation requirements. This is one of the most valued benefits of a UAE residence visa, as it allows families to stay together under one sponsorship.

For Students and Retirees

Students enrolled in UAE universities can obtain student visas through educational institutions. Retirees, on the other hand, can apply for long-term residency visas if they meet certain financial or property ownership conditions.

Types of Visa in UAE

The UAE has created multiple visa categories to suit different needs and lifestyles. Understanding the types of visa in UAE helps you select the right one.

Employment Visa

For professionals hired by private companies or government entities. This is the most common type of residence visa and is tied to your job contract.

Investor or Partner Visa

Issued to entrepreneurs or business owners investing in UAE companies. It provides flexibility in managing and operating your business in the country.

Family Visa

For residents wishing to bring their family to live with them in the UAE. It covers spouses, children, and sometimes parents or dependents under specific conditions.

Student Visa

Granted to international students admitted to UAE universities or higher education institutions.

Golden Visa UAE

The Golden Visa UAE is a long-term residence visa valid for 5 or 10 years, depending on eligibility. It is designed for investors, skilled professionals, scientists, outstanding students, and humanitarian pioneers.

Unlike regular residence visas, it doesn’t require a local sponsor and provides unmatched security and stability. Golden Visa holders can also sponsor family members regardless of age and enjoy extended stay benefits even if they spend long periods abroad.

Visa Cost in UAE and Renewal Process

Getting or renewing a visa in the UAE involves certain fees and documentation. Here’s what you should know.

Understanding the Visa Cost in UAE

The visa cost in UAE depends on the visa type, the sponsoring entity, and the duration.

Typically, the costs include:

- Entry permit issuance

- Medical tests and Emirates ID application

- Typing center and processing fees

On average, the total expense ranges between AED 2,000 and AED 7,000 for a residence visa. Investors and Golden Visa applicants might pay more, depending on their visa category and validity.

UAE Visa Renewal Process

The UAE visa renewal process is straightforward and can be done through:

- Your employer or PRO

- Typing centers approved by the UAE government

- Smart services like ICP Smart Services or DubaiNow app

You’ll need to submit updated medical results, a valid Emirates ID, and proof of continued employment, study, or sponsorship.

To avoid overstay fines, start your UAE visa renewal at least 30 days before expiry. In most cases, renewals are processed within a few days.

Additional Perks for UAE Residents

Holding a residence visa unlocks many lifestyle and financial benefits beyond just legal residency:

- Access to government discount cards such as ESAAD Card and Fazaa Card, which provide discounts on shopping, healthcare, travel, and dining.

- Eligibility for credit cards, loans, and property financing, allowing residents to build a financial life in the UAE.

- Ability to obtain a UAE driving license and register vehicles under your name.

- Freedom to sponsor domestic staff legally, such as housemaids or drivers.

- Ease of re-entry – even after spending several months abroad (especially for Golden Visa holders).

These perks make residency not only practical but also convenient for long-term living.

Conclusion

A UAE residence visa isn’t just a piece of paper – it’s a key to stability, prosperity, and a higher quality of life. From tax-free earnings and property ownership to access to exclusive perks like the ESAAD Card and Fazaa Card, residents enjoy privileges that make life in the Emirates both comfortable and rewarding.

For professionals, investors, and families seeking permanence, options like the Golden Visa UAE offer even greater flexibility and long-term benefits.

And for a select few who make significant contributions to the nation, the Royal Visa stands as the pinnacle of prestige – a symbol of the UAE’s recognition for extraordinary individuals shaping its future.

FAQs

How Long Is a UAE Residence Visa Valid For?

Most residence visas are valid for 2 to 10 years, depending on the visa category and sponsor type.

Can I Sponsor My Family Members with A UAE Residence Visa?

Yes, residents can sponsor their spouse, children, and parents if they meet minimum salary and accommodation requirements.

What Are the Main Benefits of A UAE Residence Visa?

Access to healthcare, education, banking, tax-free income, and property ownership are key benefits.

What’s the Difference Between a UAE Residence Visa and Golden Visa UAE?

A Golden Visa offers 5-10 years of residency without a local sponsor and provides additional flexibility for investors and professionals.

How Much Is the Average Visa Cost in UAE?

The visa cost in UAE typically ranges between AED 2,000 and AED 7,000, depending on the visa type and duration.

How Can I Renew My UAE Residence Visa?

You can renew it online or through your sponsor 30 days before expiry, ensuring you provide updated documents and medical test results.